China is accelerating its green energy transition by implementing a market-based renewable tariff policy, replacing the fixed-tariff system with government subsidies for renewable energy projects commissioned after June 1 2025. While this policy shift may impact profitability of energy operators in the short term, the government is also taking measures to mitigate price volatility.

China began its transition towards market-based pricing for wind and solar power in 2019. This shift involved moving away from a fixed feed-in tariff ( FIT ) system to one where electricity prices are determined by market mechanisms such as competitive bidding.

Under the FIT model, renewable power producers received a guaranteed price for the electricity they generated, regardless of market conditions. While this approach was instrumental in scaling up China’s renewable capacity, it also led to inefficiencies and long-term fiscal burdens.

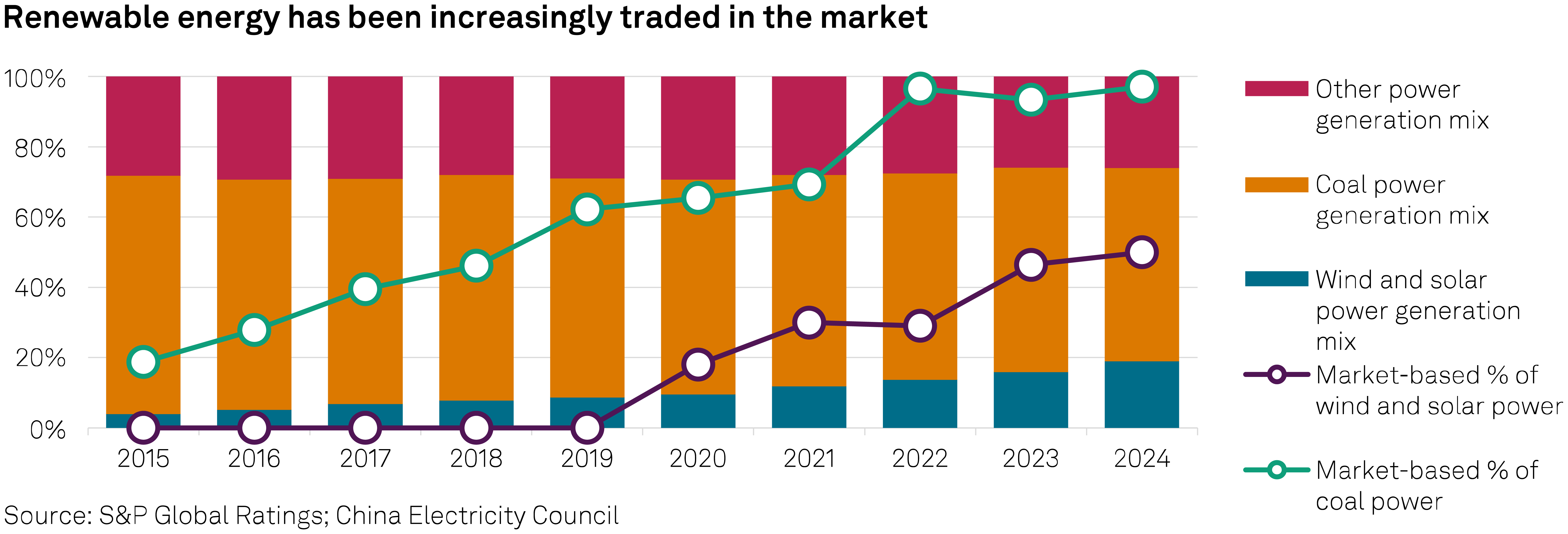

As of 2024, the system remained partially market-based, with only about 50% of wind and solar power traded through competitive mechanisms, whereas coal power had already achieved full market-based pricing, according to S&P Global.

The latest government policy requires that all renewable energy plants entering operation after June 1 2025 must sell their electricity at market prices, competing directly with fossil fuel-based power.

This move places renewable power producers on equal footing with conventional energy providers and is expected to drive long-term sector resilience. While the immediate consequence may be reduced profits due to lower prices, over time, increased competition and better price discovery will improve project quality and operational performance, S&P Global says in a new report.

The decree will primarily affect post-June 2025 projects, which currently represent a small portion of total renewable capacity. As a result, the short-term impact on overall sector profitability is expected to be manageable.

Legacy projects, which began operations before the policy deadline, still benefit from government-backed fixed tariffs and often command a price premium of around 20% over fossil-fuel generation. This advantage, however, will not extend to future projects, which must adapt to a less predictable pricing environment, according to S&P Global.

To help mitigate price volatility, new projects will have access to a mechanism tariff system, which includes annual electricity auctions. Under this system, producers will bid to supply a designated volume of electricity at a specified price.

Projects that participate in this mechanism may also be eligible for a contracts for difference ( CfD ) arrangement. During market trading, if the average market price falls below the agreed tariff, the grid compensates the producers. Conversely, if the market price rises above the tariff, the producers may reimburse the grid. This hybrid pricing structure offers greater certainty than fully open market bidding, enabling more strategic planning and operations.

Beyond pricing reforms, China’s macroeconomic environment is also supporting the green energy shift. With interest rates remaining relatively low, many independent power producers ( IPPs ) are refinancing their debt at reduced costs, freeing up capital for investment in low-carbon technologies. Average funding costs for these companies have declined by 1 to 2 percentage points between 2020 and 2024.

Chinese IPPs are further strengthening their market positions by focusing on contract negotiations, and by implementing strict cost control measures. These include cutting fuel expenses and upgrading equipment to improve efficiency and utilization rates.